PRICING FOR PROFITS CALCULATOR™

HOW TO QUOTE PROFITABLY ON EVERY JOB!

WHAT IT DOES:

Allows you to create quotes that ensure profitability on every job you take.

Understanding how to do this allows you to:

1) Adjust how you price jobs when sales fluctuate

so you stay in the black vs. in the red

2) Adjust overhead costs to maximize how

competitive you can be

3) Set profit targets and budgets so that when you

quote, you’re quoting profitably

*For a better experience all downloadables should be used in a computer

OR SCROLL DOWN TO SEE INSTRUCTIONS

WHY YOU NEED IT:

In order to quote properly, we have to charge properly

Understanding the difference between Margin and Markup could determine whether you make an extra 5% and extra 5% on your bottom line.

On a 1 million dollar business, that's a $50,000 difference! Your numbers matter. They are the language of your business.

So when it comes to quoting, the number one thing you must take into consideration in order to make profit, is your break even margin.

BEFORE WE BEGIN:

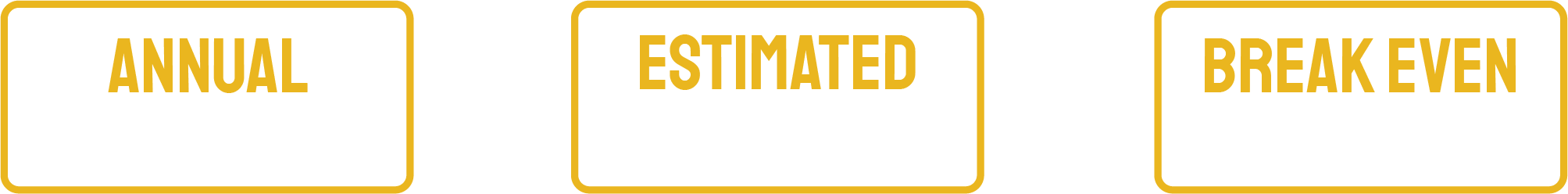

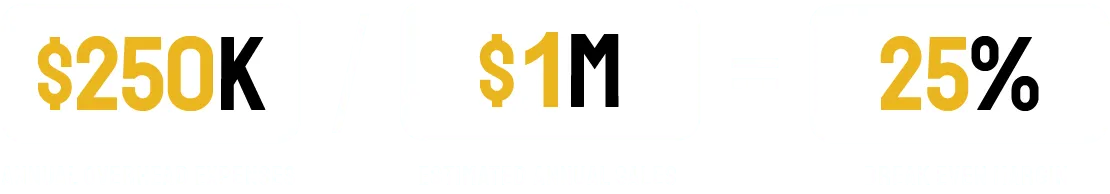

Before we get into learning the differences between Margin and Markup, there are 3 other areas (and their formulas) we need to understand and what order they go in.

They are:

Knowing these formulas will benefit you for the life of your business.

If you don’t get this right, you can't confidently answer the questions below.

QUESTIONS TO ASK YOURSELF

1) Do I know how to adjust my pricing based upon the cycles in my business?

2) Do I know how much to quote to ensure I’m profitable?

3) Am I pricing for profits or poverty?

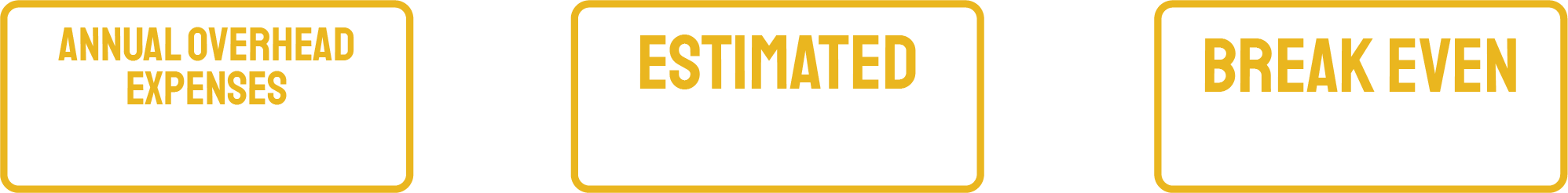

STEP 1: DETERMINE YOUR BREAK EVEN MARGIN

Your break even margin determines how much you need to charge on your quotes just to make a flat $0 (not making profit, but not losing money on the job either).

All you need is 2 numbers:

1) Annual Overhead Expenses (also known as fixed costs)

2) Estimated Annual Sales

EXAMPLE:

An electrical contractor has $250k in annual overhead expenses. (expenses must be paid regardless of getting work or not; lease, salaries, utilities, etc). His estimated annual sales are $1M. This gives him/her a Break Even margin of 25%.

STEP 2: DETERMINE YOUR BREAK EVEN

PROFIT MARGIN

Break Even Profit Margin is my own term. I see this as the amount of profit the business owner wants to make beyond the Break Even Margin.

EXAMPLE:

Continuing with the example on the previous

page, let’s say you want to make $100k net after everything has been said and done. All you do is add this to your annual overhead expenses and you’re good to go.

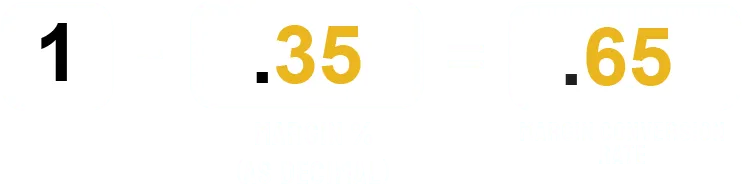

STEP 3: DETERMINE YOUR MARGIN

CONVERSION RATE

You now need to determine your margin conversion rate in order to determine what price to charge on your quote. In the previous example our the “Break Even Profit Margin” was 35%.

If you think that all you need to do is multiply your job cost by 1.35, YOU’RE MAKING A FATAL MISTAKE (one that 90% of Contractors make).

Let’s keep using a 35% “Break Even Profit Margin.” In order to estimate a profitably, we need to calculate something I call the “Margin Conversion Rate”.

EXAMPLE:

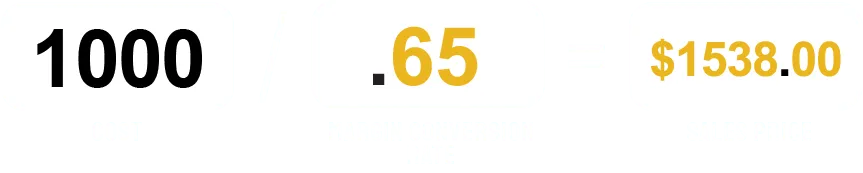

With a 35% Break Even Profit Margin (.35), we subtract

that from 1, giving us a Margin Conversion Rate of .65 (65%).

EXAMPLE:

Let's say our labor & material costs (direct job costs) are

$1000, we would take $1000/.65 = $1538.00

WARNING:

If you didn’t use the Margin Con-version Rate formula and just multiplied your $1000 cost by 1.35 (to get $1350), you could be in big trouble! Your Gross Margin (26%) = sales - expenses / sales 1% over your Break Even of 25% from Step 2.

Not only would you basically be working for nothing, but if any unforseen errors occur, you would be in the hole!

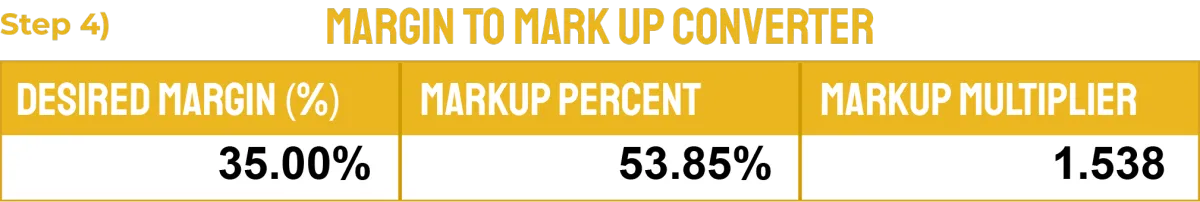

STEP 4: MARKUP VS GROSS MARGIN

Most contractors use markup to do a quote, but as you can see from the previous example, this can be dangerous.

Using Markup or Margin is fine so long as you know what the difference is.

Use the Pricing For Profits Calculator™ to know very quickly what you need to multiply your cost by in order to achieve a price that is profitable.

So how do you use this tool:

Let’s say you wanted a 35% Margin.

Step 1) Input your Desired Margin (Break Even Profit Margin).

Step 2) You’ll see that the “Mark-Up Multiplier” column which gives us 1.538

Step 3) Multiply your cost by 1.538 and you’ll get your 35% Margin.

STEP 5: GET ADDITIONAL SUPPORT

Throughout this document, Profit For Contractors showed you how important your margins are to your quotes.

This not only effects your profits, but also your time and team.

If you want to take and install The Margin to Mark Up Converter™ tool into your business but don’t know where to start, be sure to book in a quick 15 MINUTE CHAT with one of our Contractor Specialists for help!

Andrew Houston

Founder and Owner, Business Consultant

Liam Morin

Coach & Sales Manager

What this chat will do for you:

• Show you how you can be more competitive and win more work

• You’ll learn how to quote to ensure your making 20-30% GP

• Get the top 5 tips to use when quoting to increase your profits by 23%

• Receive strategies on how to get your team on board with implementing the strategies found in this too

BOOK YOUR CALL HERE

About Us

At Profit for Contractors we’re dedicated to helping you and your business flourish.

With nearly a decade of successfully helping contractors fix and grow their business to its utmost potential, we’re confident we can help you too. Constant help is always at your fingertips, and with a little work, your goals can become a reality.

Copyright © 2022 – Profit for Contractors